This is government-regulated private health insurance for individuals that supplements original Medicare by paying some health care costs that original Medicare doesn’t cover, such as deductibles and co-pays. As the name suggests, not all of your health care costs may be covered by Medicare Parts A and B, effectively creating gaps in coverage. After Medicare pays for approved amounts for covered health care costs, a supplement Medigap policy pays its share of those costs.

There are specific requirements that make you eligible to enroll in Medicare Supplement (Medigap) Insurance. To enroll you must be:

Medigap insurance is a separate premium cost in addition to your Part B coverage. Policies only cover individuals, not married couples. In many cases, Medigap Insurance from Catholic United Financial is competitively priced compared to other companies. You can get a no obligation quote online or contact your local representative to get a sample of comparison rates. The monthly premium depends on:

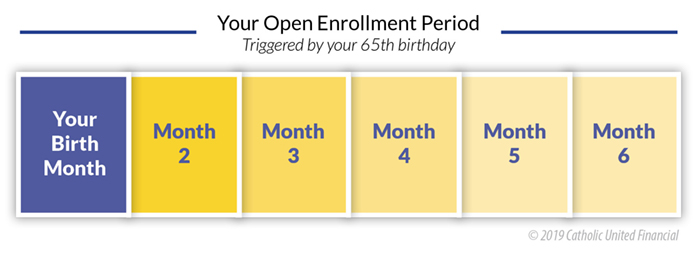

If you are eligible to enroll, your initial open enrollment period (the six months after your 65th birthday including your birth month) is your best option to enroll in a Medigap policy and get a competitive premium rate regardless of your health history. You are guaranteed to be eligible for a policy during the open enrollment period.

If you delay enrolling in Medicare Part B due to existing health insurance from an employer or union, your open enrollment period begins after you enroll in Part B. You cannot obtain Medigap health insurance until you are enrolled in both Parts A and B. Other Medigap guaranteed-issue conditions exist depending on specific circumstances. Review the “When Can I Buy Medigap” page on Medicare.gov for more details.

Certain Medicare plans in Minnesota called “cost plans” have been discontinued by the federal government as of Dec. 31, 2018. Owners of these discontinued plans have been notified by the government about replacing their plans and enrolling in supplemental coverage like Medigap. (This does not affect most seniors.) To find out if your cost plan is affected, click here.

MSW919.2 Last update: 8/20/2019