Questions?

Feedback?

info@catholicunited.org

It’s been about 35 years since America’s first 401(k)s were introduced to the consumer, and in that time they’ve gone from the niche invention of the Johnson & Johnson Company to the number one retirement savings vehicle in America.

There are two desirable features that account for this mass-adoption. First, 401(k)s allow employees to save pre-tax which lowers their taxable income. Second, these tools allow employees to save automatically through paycheck deductions and ideally amass compounding interest benefits; small contributions can grow into significant savings over a long time horizon.

Most experts agree the 401(k) is a “poor substitute” for the defined benefit pension plan1 which it replaced. There are a few reasons why these accounts are less than ideal as people get closer and closer to retirement and steps you can take to replace that risk with reliability.

First, the money you put into a 401(k) can be exposed to stock market risk. You may reliably save every week for 30 years, but a crash could wipe out your accounts just one month before you retire.

Second, 401(k) accounts are not insured. There is no way to recoup any market losses except to wait or to save more.

Third, money in a 401(k) isn’t easy to get at before retirement. Most 401(k)s grow tax deferred on pre-tax money, and withdrawals from them are treated as taxable income. And with some exceptions, you’ll also incur a 10 percent penalty on withdrawals before age 59 1/2. Most employers that offer a 401(k) also allow participants to take out loans but these must be paid back in five years and also incur a fee.

Finally, your employer controls the 401(k) plan and you are at their mercy when it comes to plan options, including what type of things that money is invested in.

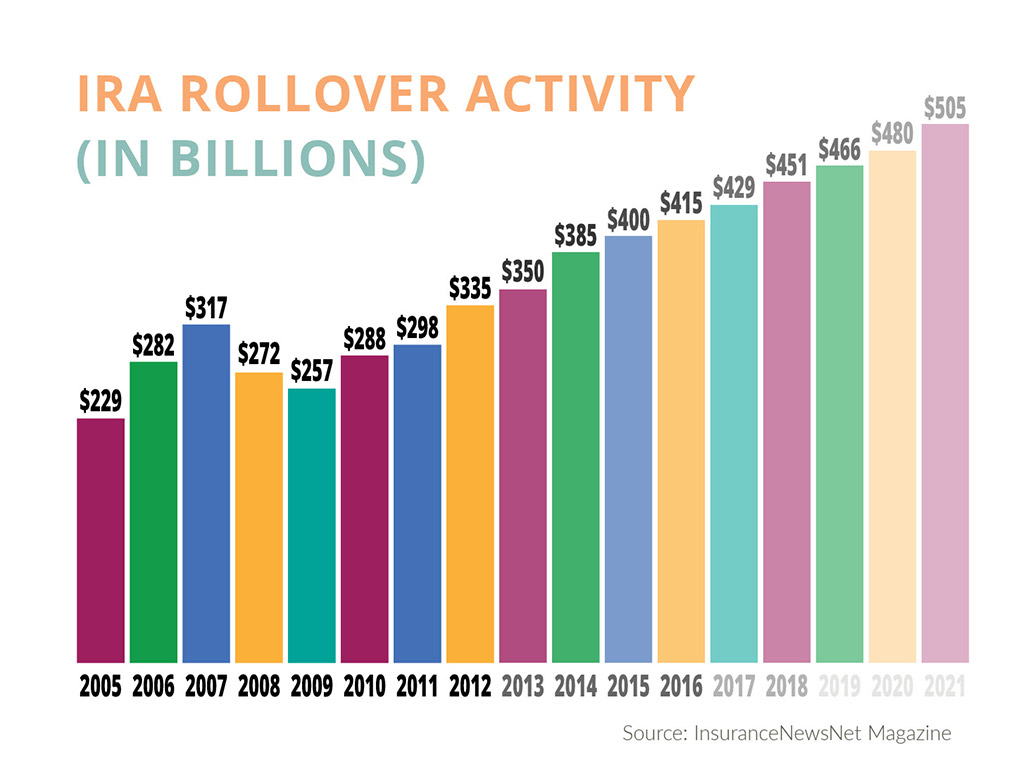

To mitigate risk, take control of your own assets and their distribution, and set up a system for lifetime income after retirement, many experts recommend “rolling over” that employee 401(k) to something else. Primarily, IRAs and annuities are the qualifying rollover destinations because they can share the same tax-deferred structure of the 401(k). The government has allowed that these rollovers into qualifying funds are not considered taxable events. As your risk tolerance diminishes and your control over these assets becomes more necessary, rolling over your employee 401(k) should be something you consider.

Unless you have an established retirement plan this advice may seem nebulous and unknown — how much money will you have for retirement?

There’s nothing more important for budgeting than knowing how much money you’re bringing in, which is what an annuity is made for. You fill up an annuity until it begins to distribute. From that point forward (usually age 65 or retirement or both), it pays you a set amount at a set time for a set duration, often a monthly distribution until the end of your life. It’s highly dependent on your situation, but an annuity can solve many of the issues that make 401(k)s less attractive as retirement nears.

Unlike a 401(k), you may see an annuity as a vehicle for distributing savings rather than creating them — though it can certainly provide a safe destination to store and grow wealth.

Fixed annuities (the kind Catholic United offers) have no stock market risk. The purchaser signs a contract, and receives an interest rate. Over time that rate may fluctuate, but there is a guaranteed minimum amount it will make.

Annuity money may be inaccessible without penalties for a number of years (often seven). When lump sums like a rollover are involved and you are near or at retirement age, immediate annuities can be purchased which allow access to your funds from the first day.

Finally, all the funds of your rollover do not have to go to the same place. Charitable donations and life insurance are also options, though taxes may apply.

Most important is simply to know what you want to do with your 401(k) when the time comes, and to decide when that time will be. Your Catholic United Financial Sales Representative would be happy to discuss your situation and help you find the best solution for you.

1Economic Policy Institute