On Oct. 15, we will enter the Medicare Supplement Annual Fall Open Enrollment Period. The enrollment period runs through Dec. 7 this year.

Even among people who own a Medicare Supplement plan, this open enrollment period can be confusing, so I’m going to explain the difference between the Annual Open Enrollment Period (AEP) and your own Personal Medigap Open Enrollment Period which might be the most important six months of your life in terms of protecting the retirement you’ve spent a lifetime saving for.

Let’s review terms: “ Medicare supplement” and “Medigap” refer the same thing, a special health insurance policy that picks up the cost on anything above and beyond what’s covered by your Medicare Part A and B coverage. Medicare supplement and Medigap do not cover things not covered by Medicare, but they do pay the amount that is unpaid on covered procedures. It’s often referred to as back-up insurance to Medicare. What that means is if you have a procedure at a hospital, Medicare Part A will cover 80 percent of your allowed hospital expenses. For the remaining balance and copays, you pay out of pocket or you purchase a Medicare supplement health insurance policy. You pay a monthly premium on your Medigap policy and in return the medical expenses that are partially covered by Medicare now become fully covered. It fills the gap and pays that extra 20 percent that Medicare leaves up to the consumer.

Medicare Advantage is not the same thing as Medigap. Medicare Advantage combines A and B into a single package managed by a third-party, private company that contracts with Medicare. Premiums for Advantage plans are paid to the company, which will often include an eye checkup or annual dental cleaning. These premiums can be lower than those of a Medigap policy, but they generally include some cost sharing (co-payments and deductibles) that you pay out of pocket.

While the Advantage plans may appear to have a lower upfront premium, I often find that there are more potential costs with Medicare Advantage. I try to remind people neither our health nor our healthcare costs are expected to improve as we age.

Some other considerations of an Advantage plan are that it is a network plan – so you may not be able to travel with it. If you do, you will pay more out of pocket when you’re out of town. More importantly, it may not cover the expenses above what Medicare part A and B cover. It merely combines part A and B to make for a “simpler” package. In my experience, despite a slightly higher premium, a Medigap policy is far more beneficial for the average individual than a Medicare Advantage plan.

Now that we’re clear about Medigap and Medicare Advantage, why are we hearing and seeing so much about them both right now? It’s that Annual Open Enrollment Period (AEP). During the AEP, you can:

• Switch from Medicare to Medicare Advantage, or vice versa;

• Make a change to a different Medicare Advantage plan or Medicare Part D (drug) plan; or

• Add Medicare Part D (although a penalty may apply if you delay enrollment in Part D from the time of your initial enrollment).

This period is important for people who are considering making a change to their current Medicare or Medicare Advantage. The enrollment periods can be confusing. There is no harm in looking into the AEP, so long as you don’t miss out on your Personal Open Enrollment Period.

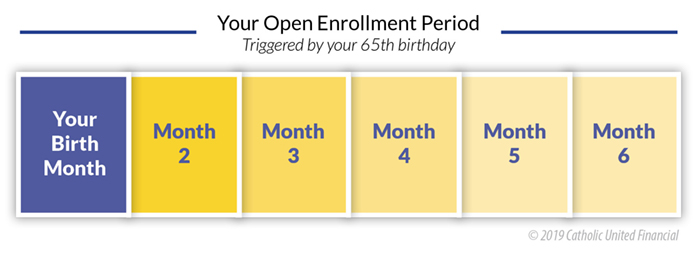

If you’re skimming, make sure you stop and read this paragraph: Your personal open enrollment period is a once-in-a-lifetime window. It opens as soon as you enroll in Medicare Part B and closes exactly six months after your Part B takes effect. During this window only you may purchase any Medicare supplement policy (Medigap) with no health questions and you will be guaranteed coverage. (Note: There are a number of Medigap policies, which are standardized by the government and also use letters as designations: Medigap G, F, N, etc.)

You will never be given the opportunity for guaranteed enrollment like your Personal Open Enrollment Period again, so use it. After it ends, if you enroll or change plans you will be subject to a health underwriting for the new coverage which means potentially higher premiums or even denial of coverage.

I find it important to inform people of their once-in-a-lifetime “Personal Open Enrollment” period. If you delayed purchasing a Medicare supplement policy when you first enrolled in Medicare Part B and then develop a condition such as dementia, Parkinson’s Disease, cancer, etc., you can be denied coverage for a Medicare Supplement plan. This can force you to “self insure” which is a fancy way of saying you will pay for that 20 percent gap left over by Medicare.

Whether it’s for yourself, a spouse, or a parent who is retiring and entering Medicare, getting a Medigap policy as soon as you sign on for Part B can fundamentally impact your retirement budget for the rest of your life.

Think of it this way; at 65 years old, your health care costs are almost guaranteed to go up as you age. This is just based on getting older, not even factoring in medical care inflation (which far outstrips the inflation index.)

If you miss out on this period or choose not to participate, you will never again be allowed to apply for a policy without medical underwriting. If you develop dementia or other chronic conditions, you may be denied a Medicare Supplement outright – meaning you will be perpetually liable for the 20 percent that your Medicare Part A and B do not cover. I’m not sure if you’ve checked the price of a hip replacement or even an overnight stay in the ICU. Your out of pocket of 20 percent of these expenses is a significant sum.

Until a more perfect solution is found, Medicare supplement health insurance is an essential tool in maintaining your financial security and independence. Don’t confuse the open enrollment periods, and certainly, do not miss out on your personal window. Start your search early, even a year before you plan to retire. Start familiarizing yourself with your options. Go to www.medicare.gov to learn all about the important timelines you need to adhere to.

Tara Donohue Weiss is the Medicare Subject Matter Expert at Catholic United Financial. Visit www.catholicunitedfinancial.org/medicare-supplement or email medsupp@catholicunited.org to contact Tara directly.

byTara Donohue Weiss, Medicare Supplement Specialist

Questions? Feedback? medsupp@catholicunited.org